As the end of the school year approaches, many high school and college students find themselves scrambling for summer jobs so that they can save up some spending money.

Unfortunately, there aren’t many decent paying jobs available for teens, especially in a rough economic climate. However, there are a number of websites that offer very easy money for teens online. For a teenager who is disciplined and responsible, online jobs are the easiest way to earn a significant wad of cash this summer.

Websites That Offer Easy Money for Teens

Teenagers today typically have an assortment of skills that are useful and valuable on the Internet. For teens who are skilled writers, earning money will be that much simpler. Additionally, there are also well paying jobs available for teenagers who know how to write web pages, write high-volume blogs or forum posts, or program in different Internet or desktop programming languages. However, finding those opportunities often involves wading through a mountain of garbage and scams. This article will provide teens with a guideline for the best opportunities on the web that offer easy money for teens.

1. Easy Income for Teens Who Can Write Articles

For any teen that has excellent writing skills, the Internet offers an abundance of cash just sitting there for the taking. Yes, it may take a full eight hours a day of good solid writing work – but what could be better than rolling out of bed at ten in the morning and going to work at home, in your pajamas? Sound too good to be true? Well put on your pajamas and check out these opportunities.

Associated Content

Associated Content is one of the most popular “user-generated content” sites that offers articles on just about every topic under the sun.

At Associated Content, you can either “claim” topics from the assignment desk, or you can submit topics of your choosing. You can earn both upfront payments, as well as monthly payments based on traffic to your articles. Starting out, you might only earn $3 to $4 per article you write, plus $1 to $2 for traffic – but if you wrote 5 articles a day, that’s $400 a month, plus additional monthly royalty payments.

Not only does writing for a site like AC establish you as a writer, but if your writing is exceptional, AC will even consider you as a preferred content producer, and their clients may ofter you writing gigs that pay $20 and up for an article.

Helium

Helium is another user-generated content forum that pays you both upfront fees as well as traffic royalties.

Helium is unfortunately a bit cheaper with their payments, and they’ve established a bunch of loopholes you need to jump through. You can earn about $1 per article plus traffic payments. However, to earn those payments you have to spend time “rating” articles – a painful and tedious process of comparing two articles and picking the one that’s better. But with Helium, the real money is in the “marketplace” section, where you can compete on client writing gigs worth anywhere from $5 to $100 or more.

Triond

Triond is another content site that accepts your articles and pays you royalties for traffic.

Triond is one of the few sites known for actually sending authors the payouts they’ve earned, so it deserves mention here. However, if you want to use Triond to add an income stream to your summer writing, you’ll need to submit a very large quantity of articles that are well written with SEO in mind, and can attract a very large stream of readers from the search engines. If you can accomplish that, then yes – you can earn money from Triond.

2. Make Money Writing Reviews or Writing Letters

One of the most popular reasons many people use the Internet is to research products before buying them. This has turned “reviews” into one of the most popular types of content online. If you like writing up product reviews, then there are countless opportunities to earn income from your written opinions.

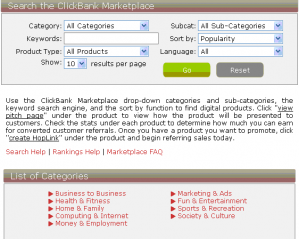

I’ve written for

Shared Reviews (the image above) before, because they do legitimately pay their authors. However, I’ve also heard that

Epinions is another great review site to earn money from.

Have your friends ever told you that you’re amazing at writing letters? Then consider spending your summer creating custom letters at

Letter Rep. Yes, the website isn’t exactly the prettiest site in the world – but by submitting letters to custom letter requests that visitors submit to the site, you stand to earn $10 per letter. Not only that, future visitors to the site can also purchase your letters, making your pile of work a wonderful source of residual income, not only throughout the summer, but even throughout the school year.

3. Quick Money for Teen Programmers

If you are an ace programmer with any programming language, you could spend your summer doing programming freelance jobs for some real cash. However, when it comes to finding freelance work, you have to be very careful what websites you visit – as most of them are useless or flat out scams.

Scriptlance is about as far from a scam as you can get. At the beginning of my online writing career, I spent months sifting through the latest project postings there (there are dozens per hour), and bidding on the ones that matched my skill set. There’s writing work, but the bulk of Scriptlance is programming work. If you post a professionally written proposal to the person who posted the project, your chance of landing the gig will be excellent. Just working on scriptlance projects alone, you could easily earn several thousand dollars by the end of the summer.

Other legitimate freelancing sites (although none quite as big as Scriptlance), include

Rent A Ghost Writer,

Elance, and

iFreelance. Be sure to watch for new updates often, and be the first to post a bid.

Work Hard, Be Persistent, and Rake in the Dough!

The key for teens to successfully earn a small fortune during summer break through online work is by staying persistent, even when it looks like you’ll never land that first gig. Keep posting your daily articles to the royalty paying websites, and bid on freelance projects constantly. Soon, you’ll find that you have more work than you know what to do with. If you can discipline yourself to work for at least eight hours straight for every weekday during the summer – you’ll save far more money than any of your friends could earn waiting tables or mowing lawns!

Have you ever earned money from any of the sites listed in this article? Are there any good opportunities missing? Share your opinion in the comments section below.W